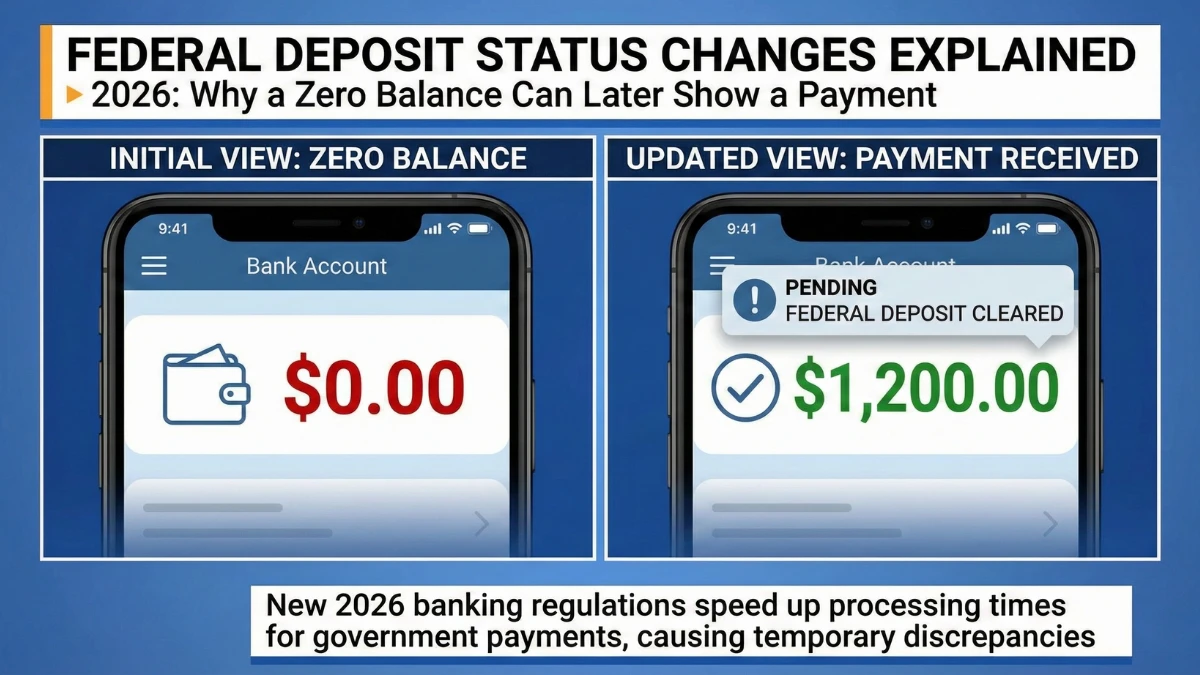

Searches for federal deposit status changes in 2026 have increased after some taxpayers noticed their account or refund status move from $0 to a payment amount during processing. To avoid misleading interpretations and spam-style claims, it is important to clarify that this change does not indicate a new stimulus or guaranteed payout. This article explains the legitimate reasons a zero status can later update to a deposit amount, based on verified procedures followed by the Internal Revenue Service.

Is There a New Federal $2,000 Deposit Rule in 2026

There is no new federal rule in 2026 that automatically converts a $0 status into a $2,000 payment. No law, executive order, or IRS notification authorizes such a mechanism. Any amount that appears later is tied to existing processes, not a newly introduced benefit.

Why a $0 Status Can Change During Processing

A $0 status often appears when a return, credit, or adjustment is under review or incomplete. Once verification is completed, the system may update to reflect a refund, credit, or correction that was already part of the taxpayer’s account.

Common Legitimate Reasons for Status Updates

| Reason | Explanation |

|---|---|

| Tax refund adjustment | Recalculation after review |

| Credit correction | Eligible credits applied later |

| Amended return processed | Updated figures replace $0 |

| Withholding reconciliation | Overpayment identified |

| IRS error correction | System or filing issue fixed |

Does This Mean Everyone Will Receive $2,000

No. There is no universal payment amount tied to a status change. The final figure depends on individual tax filings, credits, and corrections. Any specific amount varies by case and is not part of a general payment program.

Timing of Status Updates

Status changes can occur days or weeks after filing or review begins. Processing times depend on verification checks, document matching, and workload. A delayed update does not indicate a new benefit announcement.

IRS Guidance and What Taxpayers Should Do

The IRS has not issued guidance linking status changes to a new federal deposit program. Taxpayers should monitor their official IRS account or refund tracker and avoid third-party claims suggesting guaranteed payments.

Key Facts

- No new federal rule converts $0 into $2,000 automatically

- Status changes occur due to refunds or corrections

- Amounts vary by individual tax records

- No new payment program is approved for 2026

- Only official IRS updates are reliable

Conclusion

A federal deposit status changing from $0 to a payment amount in 2026 is the result of normal tax processing, not a newly introduced benefit or stimulus. Understanding this distinction helps prevent confusion and misinformation. Any confirmed payment will always be supported by official government communication.

Disclaimer

This article is for informational purposes only and does not constitute financial, legal, or tax advice. Federal deposits and refunds depend on individual records, applicable laws, and official IRS procedures.