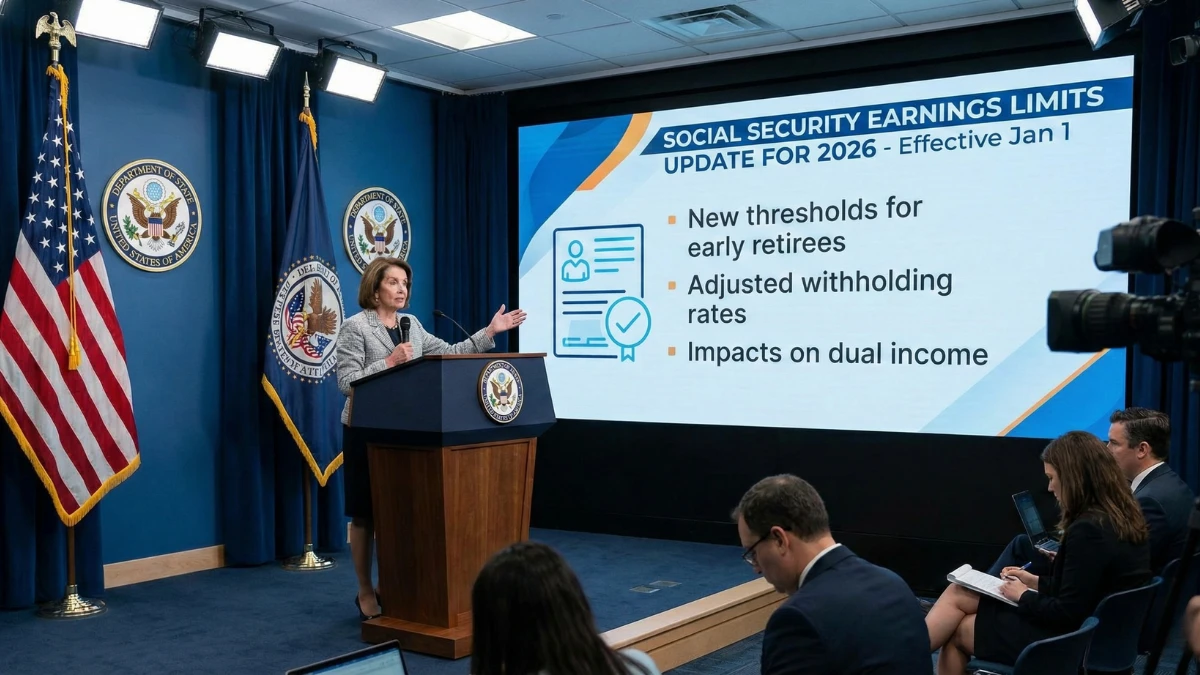

The rules for working while collecting Social Security in 2026 have changed, directly affecting monthly Social Security payments, earnings limits, and benefit reductions, making it important for retirees and early claimers to understand how continued employment can impact both short-term income and long-term retirement benefits.

Why Social Security Work Rules Are Changing in 2026

The update to Social Security work rules 2026 is driven by inflation adjustments, workforce participation trends, and sustainability planning, ensuring that earnings limits and benefit calculations remain aligned with current economic conditions.

Social Security Work Rules and Earnings Limits in 2026

| rule area | 2026 update |

|---|---|

| earnings limit (below fra) | adjusted higher |

| benefit reduction | applies if limit exceeded |

| full retirement age rule | no penalty after fra |

| benefit recalculation | credits added later |

How Earnings Affect Social Security Benefits Before FRA

Under the 2026 Social Security earnings rules, beneficiaries who work before reaching full retirement age (FRA) may see temporary benefit withholding if income crosses the annual earnings limit, although withheld amounts are not permanently lost.

What Changes After Reaching Full Retirement Age

Once full retirement age is reached, individuals can earn unlimited income without Social Security benefit reductions, and previously withheld benefits are recalculated to increase future monthly Social Security payments.

Why Working Can Increase Long-Term Social Security Income

Continuing to work while collecting Social Security benefits can increase lifetime income because higher earnings may replace lower-earning years in the benefit formula, resulting in permanent benefit increases.

Who Is Most Affected by the 2026 Rule Changes

- early social security claimants

- part-time working retirees

- self-employed beneficiaries

- people below full retirement age

- high-income earners

Conclusion

The Social Security work rule changes in 2026 make it essential to manage earnings carefully, as working while collecting benefits can temporarily reduce payments but may significantly improve long-term retirement income.

Disclaimer

This article is for informational purposes only and does not constitute financial or legal advice, as Social Security rules, earnings limits, and benefit formulas may change based on official government updates.