Taxpayers often notice big differences in IRS refund timing depending on whether they file electronically or submit a paper return. This can create confusion and lead to false assumptions about delays or errors. In reality, the IRS processes returns using different systems and timelines based on filing method. This article explains the verified timing differences, what affects refund speed, and how the Internal Revenue Service handles electronic versus paper filings.

Does Filing Method Affect IRS Refund Timing

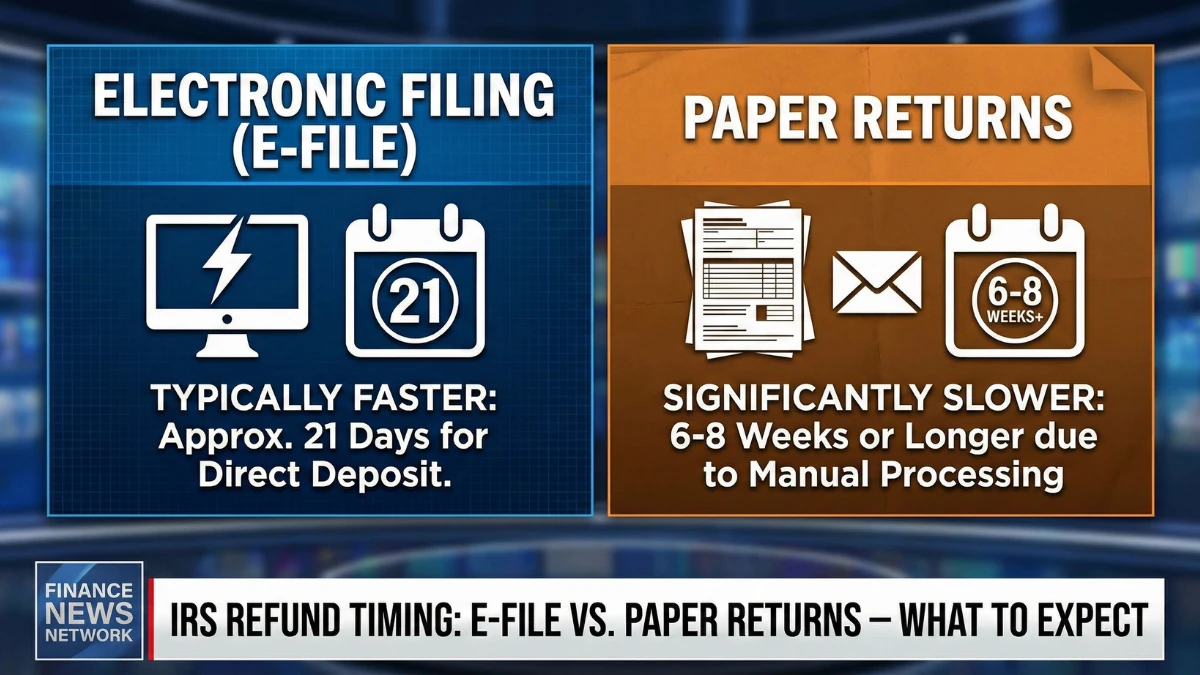

Yes. Filing method is one of the biggest factors affecting how quickly a tax refund is issued. Electronic returns are processed much faster than paper returns because they are validated automatically by IRS systems.

Electronic Filing (E-File): How Refund Timing Works

E-filed returns move directly into IRS processing systems, where math checks and data matching occur automatically. When paired with direct deposit, refunds are typically issued within about 21 days, assuming no review or correction is required.

Paper Filing: Why Refunds Take Longer

Paper returns must be physically opened, scanned, and manually entered, which significantly increases processing time. Any missing information or calculation errors can further delay refunds.

Electronic vs Paper Filing Timeline Comparison

| Filing Method | Typical Refund Timing |

|---|---|

| E-file + direct deposit | Around 21 days |

| E-file + paper check | Longer than 21 days |

| Paper return | Several weeks or more |

| Paper return with errors | Additional delay likely |

| Amended return | Much longer processing |

Why Some E-Filed Refunds Still Take Longer

Even with electronic filing, refunds can be delayed due to identity verification, credit reconciliation, missing forms, or manual review. These delays are case-specific, not system-wide.

Does Refund Amount Affect Timing

No. Refund amount does not determine processing speed. A large or small refund follows the same review steps. Timing depends on filing method, accuracy, and verification needs.

How Refund Status Is Updated

Refund status updates appear after the IRS accepts the return and begins processing. Status tools show progress stages, not guaranteed payment dates.

What Has Not Changed

There are no new IRS refund rules tied to filing method. The faster processing of e-filed returns has been standard practice for years.

Key Facts

- E-filed returns are processed much faster than paper returns

- Direct deposit is the fastest way to receive a refund

- Paper returns require manual handling

- Errors or verification can delay any refund

- Refund amount does not affect timing

Conclusion

IRS refund timing differs significantly between electronic and paper filers due to how returns are processed. Choosing e-file with direct deposit remains the fastest and most reliable option, while paper filers should expect longer wait times. Understanding these differences helps taxpayers set realistic expectations and avoid misinformation.

Disclaimer

This article is for informational purposes only and does not constitute tax or financial advice. IRS refund timing depends on individual returns and official processing procedures.