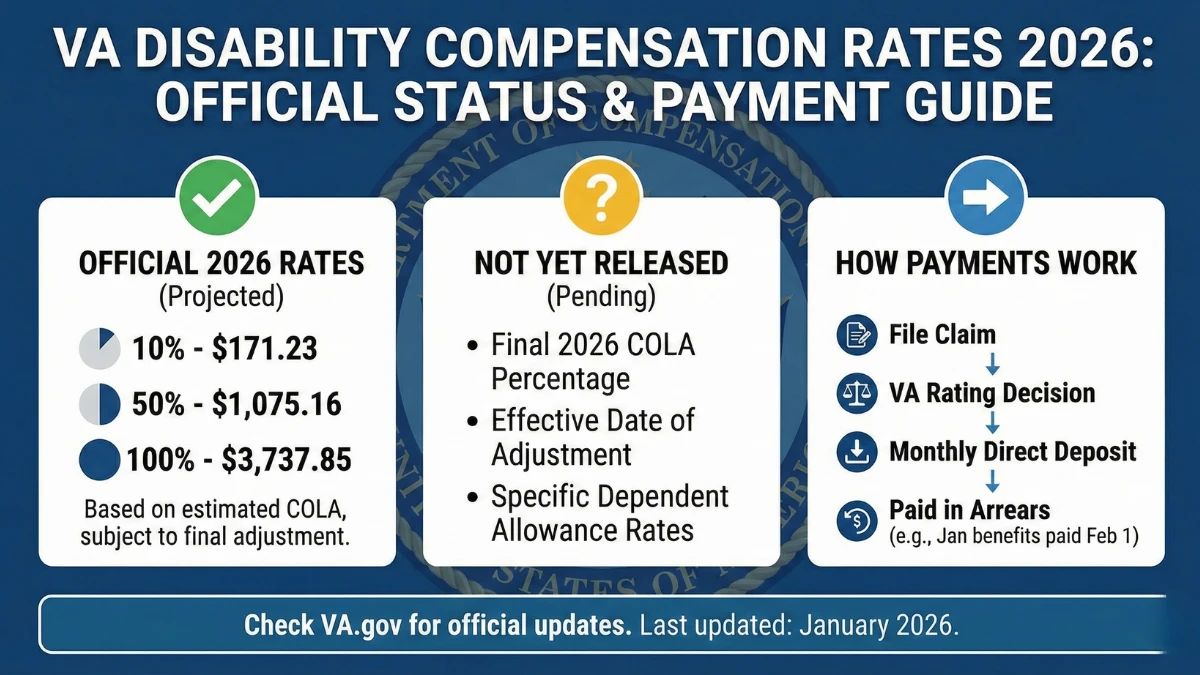

VA Disability Compensation Rates 2026: What Is Official, What Has Not Been Released, and How Payments Work

Searches for a VA Disability Pay Chart for 2026 with “new monthly rates announced” have increased, but it is important to separate confirmed information from misleading claims. As of now, no official 2026 VA disability pay chart has been formally released. VA compensation rates change only through authorized annual adjustments and are published officially by … Read more