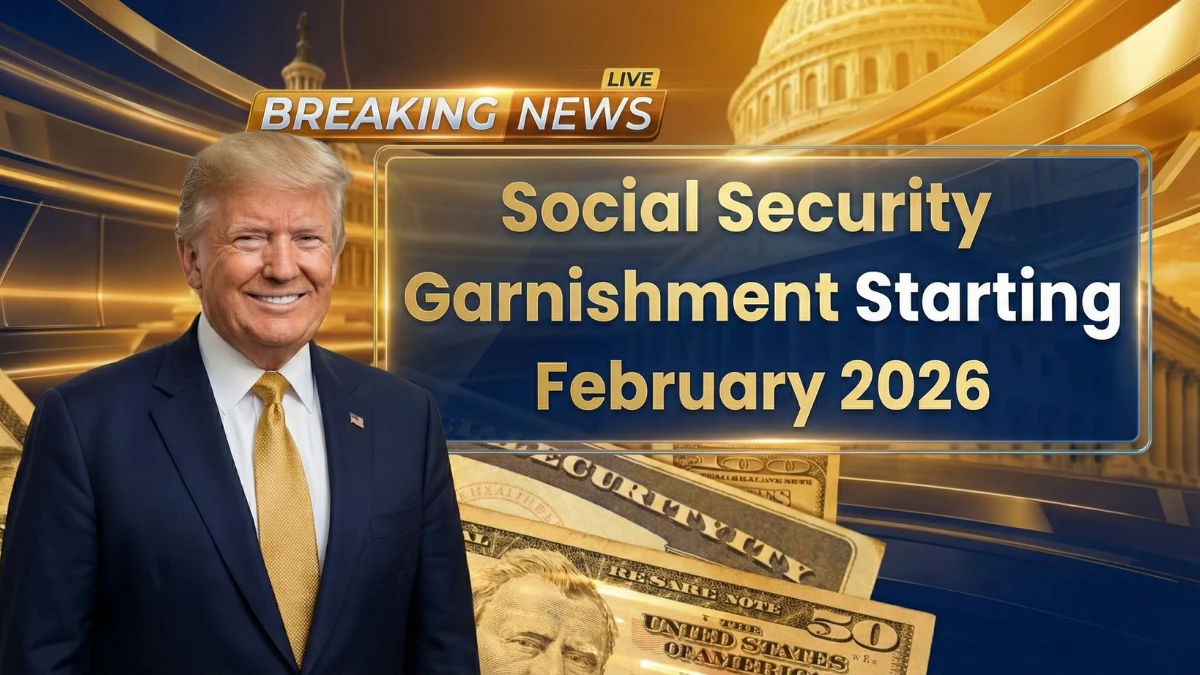

Working While Receiving Social Security in 2026: What Actually Applies Under Current Law

Claims that rules are changing in 2026 for working while collecting Social Security have circulated widely, often implying new penalties or restrictions. To avoid misinformation and spam-style framing, it is important to clarify that no new law has changed the rules for working while receiving Social Security benefits. This article explains the current, verified rules, … Read more