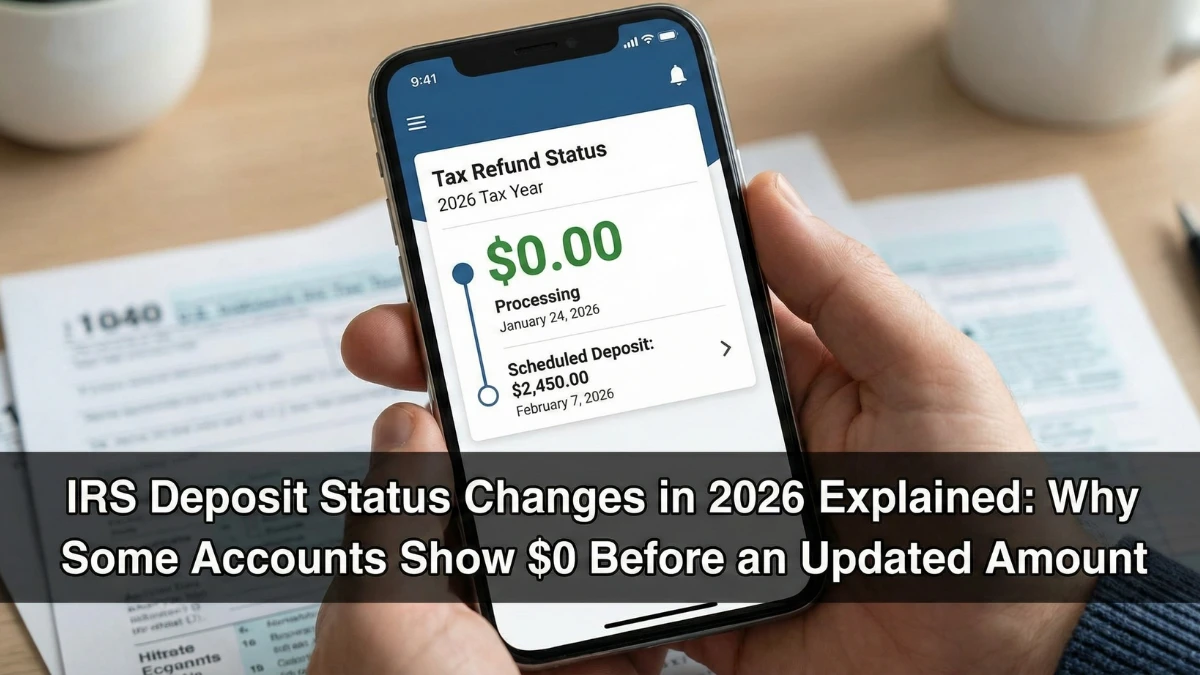

Some taxpayers notice unusual activity in 2026 where an IRS-related deposit briefly shows $0, followed later by an updated refund amount, sometimes reported as around $2,000. This can look alarming, but in most cases it reflects normal processing stages, not a new payment program or bonus. This article explains the verified reasons these status changes happen, how IRS systems process refunds, and what the Internal Revenue Service officially follows.

Is a $0 IRS Deposit a Real Payment

No. A $0 amount is not a payment. It is usually a placeholder or pre-notification created by banks or IRS processing systems while a refund is being verified, adjusted, or finalized.

Why Accounts May Show $0 First

Banks and payment networks sometimes display pending or test entries before the final amount posts. This does not mean the IRS sent a zero-dollar refund.

Common Reasons the Amount Updates Later

| Reason | What It Means |

|---|---|

| Pending authorization | Refund not finalized yet |

| Verification review | Identity or credit checks |

| Adjustment in progress | Refund recalculated |

| Bank pre-posting | Placeholder entry shown |

| Offset processing | Debt review before release |

Why Some Taxpayers Later See an Updated Amount

Once IRS checks are completed, the final approved refund amount replaces the placeholder. For some taxpayers, this amount may be around $2,000 depending on withholding, credits, or corrections—but this is individual, not universal.

Does This Mean a New $2,000 Program Exists

No. There is no automatic $2,000 IRS payment program in 2026. Any amount that appears is tied strictly to the individual tax return, not a nationwide benefit or deposit.

Refund Adjustments and Timing

Refunds can change due to math corrections, credit reconciliation, or offsets. During this process, account displays may update more than once before the final deposit posts.

What the IRS Has Not Announced

There are no new rules, no staged payment system, and no special deposits that begin at $0 and convert into a fixed amount. All refunds follow existing tax law and verification procedures.

What Taxpayers Should Do

Wait for the refund to finalize, monitor official IRS refund status tools, and read any IRS notices explaining changes. Avoid filing duplicate returns or acting on unverified claims.

KEY FACTS

- $0 entries are placeholders, not payments

- Final refund amounts depend on individual returns

- No new $2,000 IRS deposit program exists

- Adjustments can occur before funds are released

- IRS notices explain any changes

Conclusion

Seeing a $0 status followed by an updated refund amount in 2026 is usually part of routine IRS and bank processing. It does not indicate a new payment or special deposit. Taxpayers should rely on official IRS updates and written notices for accurate information.

Disclaimer

This article is for informational purposes only and does not constitute tax or financial advice. IRS deposits and refund processing are governed by federal tax law and official IRS procedures.