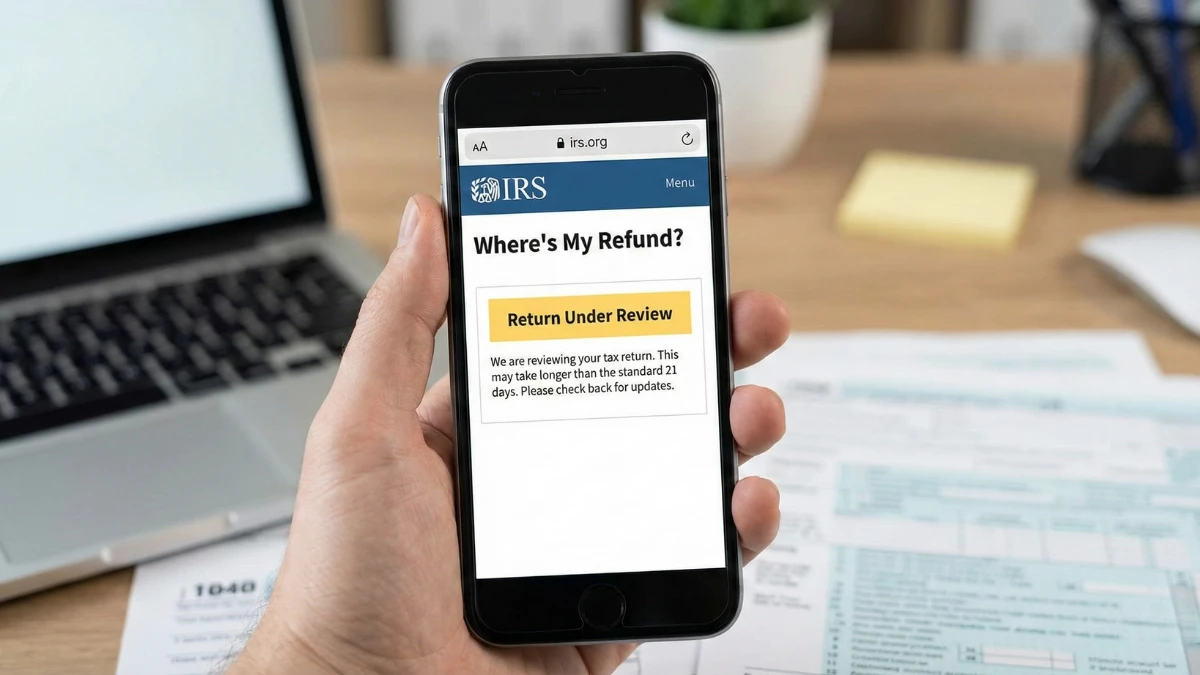

Seeing “Return Under Review” on IRS refund tracking can be worrying, but it usually reflects routine verification steps, not a denial or audit. This status means the return needs additional checks before a refund is finalized. This article explains what triggers the review, how long it can last, and what taxpayers should (and shouldn’t) do—based on standard procedures of the Internal Revenue Service.

What “Return Under Review” Actually Means

“Return Under Review” indicates the IRS is performing additional automated or manual checks on your return. The review can occur before or after initial acceptance and is intended to confirm accuracy, identity, or eligibility for certain credits.

Common Reasons a Return Is Placed Under Review

| Trigger | Why It Happens |

|---|---|

| Identity verification | Protects against fraud |

| Credit reconciliation | Confirms refundable credits |

| Income matching | Compares with employer reports |

| Math discrepancies | Corrects calculation errors |

| Missing or inconsistent info | Requires clarification |

Is a Review the Same as an Audit

No. A review is not an audit. Most reviews are automated checks that resolve without taxpayer action. Audits are formal examinations with separate notices and timelines.

How Long “Under Review” Can Last

There is no fixed timeline. Simple checks may resolve quickly, while cases involving identity verification or credit reconciliation can take longer. During peak season, reviews may extend due to volume.

Will a Review Change My Refund Amount

Sometimes. If the IRS corrects a math error, reconciles credits, or applies offsets, the final refund amount may change. The IRS sends a notice explaining any adjustment.

What Taxpayers Should Do While Under Review

Continue monitoring your status, watch for official IRS notices, and ensure your contact information is current. Do not file a duplicate return or amend unless the IRS instructs you to do so.

What Has Not Changed

There are no new rules tied to this status, and it does not automatically mean rejection, audit, or penalty. Reviews are part of long-standing processing safeguards.

ONE Bullet-Point Section (KEY FACTS)

- “Under Review” is a verification step, not a denial

- Most reviews resolve without taxpayer action

- It is different from an audit

- Refund amounts can change if corrections are made

- IRS notices explain outcomes

Conclusion

“Return Under Review” is a common, protective step in IRS processing. While it can delay a refund, it usually resolves once checks are complete. Rely on official IRS communications and avoid unnecessary actions that could slow the process.

Disclaimer

This article is for informational purposes only and does not constitute tax or financial advice. IRS refund processing and reviews follow official procedures and timelines.