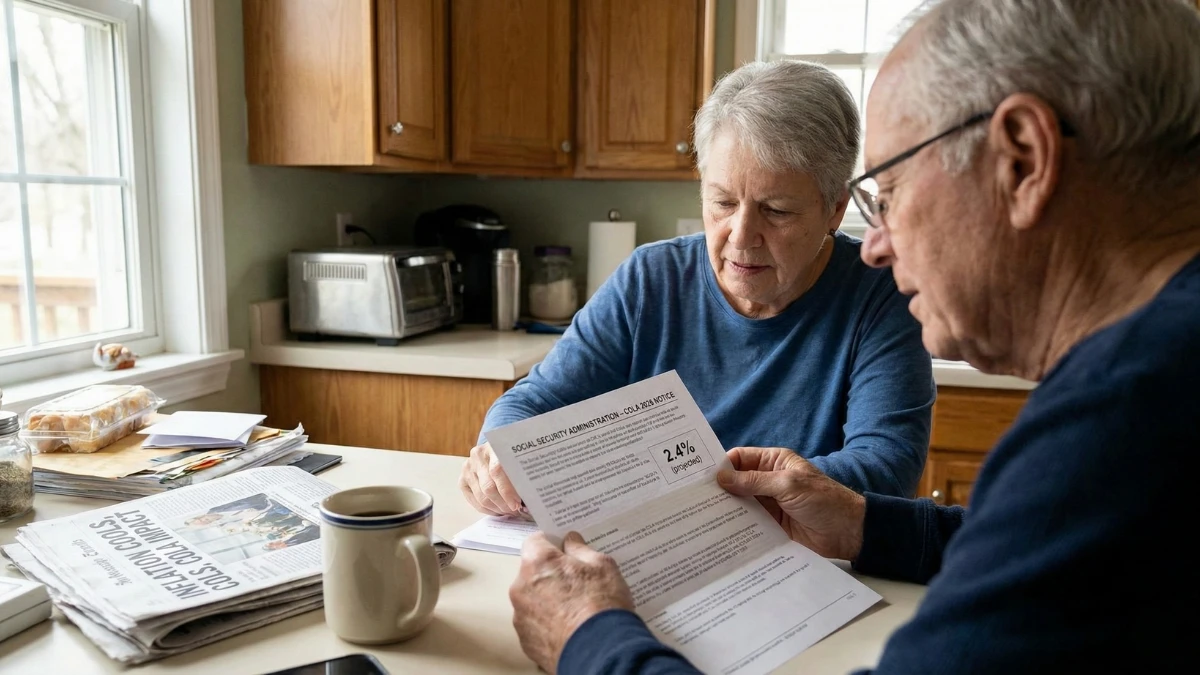

Interest in Social Security COLA for 2026 is growing, with many beneficiaries wondering whether payments will rise and by how much. To avoid speculation and misleading claims, it’s important to understand that COLA follows a set, inflation-based formula, not announcements or promises. This article explains what is confirmed, how COLA is determined, when changes would appear, and what beneficiaries of the Social Security Administration should realistically expect.

Is the 2026 Social Security COLA Confirmed

No. The 2026 COLA has not been announced or finalized. COLA is calculated using inflation data from a defined measurement period. Until that data is complete and officially published, no percentage increase can be confirmed.

How Social Security COLA Is Calculated

COLA is based on changes in a federal consumer price index that measures inflation. If prices rise compared to the prior period, benefits increase by the same percentage. If inflation is low or flat, the adjustment may be small or zero.

When COLA Changes Take Effect

When approved, COLA adjustments apply to benefits starting in January of the applicable year. Beneficiaries do not need to apply; increases are applied automatically to eligible payments.

What COLA Affects and What It Does Not

| Area | Official Impact |

|---|---|

| Monthly benefit amount | May increase |

| Eligibility rules | No change |

| Retirement age | No change |

| Payment schedule | No change |

| One-time bonus payments | Not included |

Why COLA Amounts Vary Each Year

COLA percentages vary because inflation varies. Higher inflation leads to larger adjustments, while lower inflation results in smaller increases. This year-to-year variation is expected and normal.

Why Early COLA Estimates Can Be Misleading

Preliminary estimates often circulate before official data is finalized. These estimates are not guarantees and can change as additional inflation data becomes available.

What Has Not Changed

There are no new rules, no special eligibility expansions, and no automatic bonus payments tied to COLA. The process remains formula-driven and consistent with long-standing law.

What Beneficiaries Should Do

Review official SSA announcements when released, check benefit notices for January updates, and avoid relying on unofficial sources that present estimates as confirmed figures.

KEY FACTS

- The 2026 COLA is not yet finalized

- COLA is based strictly on inflation data

- Increases apply automatically if approved

- Eligibility and payment dates do not change

- Only SSA announcements are official

Conclusion

Social Security COLA for 2026 will be determined by verified inflation data, not speculation. Until the SSA releases an official announcement, beneficiaries should expect the same transparent, formula-based process that has governed COLA for decades.

Disclaimer

This article is for informational purposes only and does not constitute financial, legal, or retirement advice. Social Security benefit adjustments are subject to official SSA calculations and federal law.