Social Security Cost-of-Living Adjustments, commonly known as COLA, are often surrounded by exaggerated headlines suggesting dramatic benefit increases or sudden rule changes. In reality, COLA is a routine, law-based adjustment tied strictly to inflation, not a special bonus or policy shift. This article explains how COLA actually works, what it changes, what it does not, and what beneficiaries of the Social Security Administration should realistically expect—without hype or misleading claims.

What a Social Security COLA Really Is

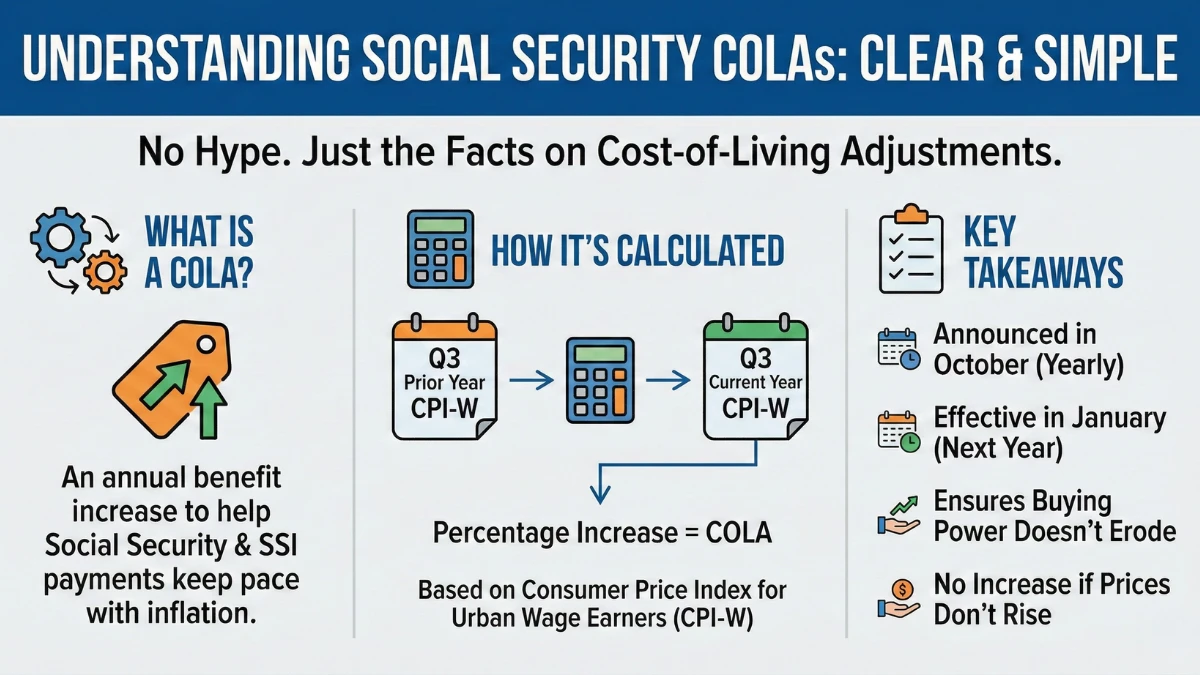

A Social Security COLA is an annual percentage adjustment applied to monthly benefits to help offset rising living costs. It is calculated using inflation data and applies automatically when prices increase over a specific measurement period. COLA exists to maintain purchasing power, not to expand benefits or alter eligibility.

How COLA Is Calculated and Applied

COLA is based on changes in a federal inflation index that tracks consumer prices. When inflation rises compared to the previous year, benefits increase by the same percentage. If inflation is flat or low, the adjustment may be small or not applied at all.

What COLA Changes vs What It Does Not

| Area | Official Reality |

|---|---|

| Monthly benefit amount | May increase |

| Eligibility rules | Do not change |

| Retirement age | No effect |

| Payment schedule | No change |

| One-time bonus payments | Not included |

Why COLA Amounts Differ From Year to Year

COLA amounts vary because inflation varies. High inflation years lead to larger adjustments, while low inflation years result in smaller or no increases. This fluctuation is normal and expected under the existing formula.

Why COLA Headlines Are Often Misleading

Many headlines frame COLA as a new government decision or special approval, but COLA is automatic and formula-driven. It does not require new legislation and does not reflect discretionary policy choices.

Who Receives COLA Increases

All eligible Social Security beneficiaries receive the same percentage increase, even though the dollar increase differs based on each person’s monthly benefit amount.

KEY FACTS

- COLA is based only on inflation data

- Increases apply automatically, no application required

- Eligibility rules do not change because of COLA

- Dollar increases vary, percentages do not

- COLA is not a bonus or special payment

Conclusion

Social Security COLA adjustments are predictable, rule-based, and limited to inflation protection. They do not signal new benefits, policy shifts, or expanded eligibility. Understanding how COLA actually works helps beneficiaries plan realistically and avoid unnecessary confusion.

Disclaimer

This article is for informational purposes only and does not constitute financial, legal, or retirement advice. Social Security benefit adjustments are governed by federal law and official SSA calculations.