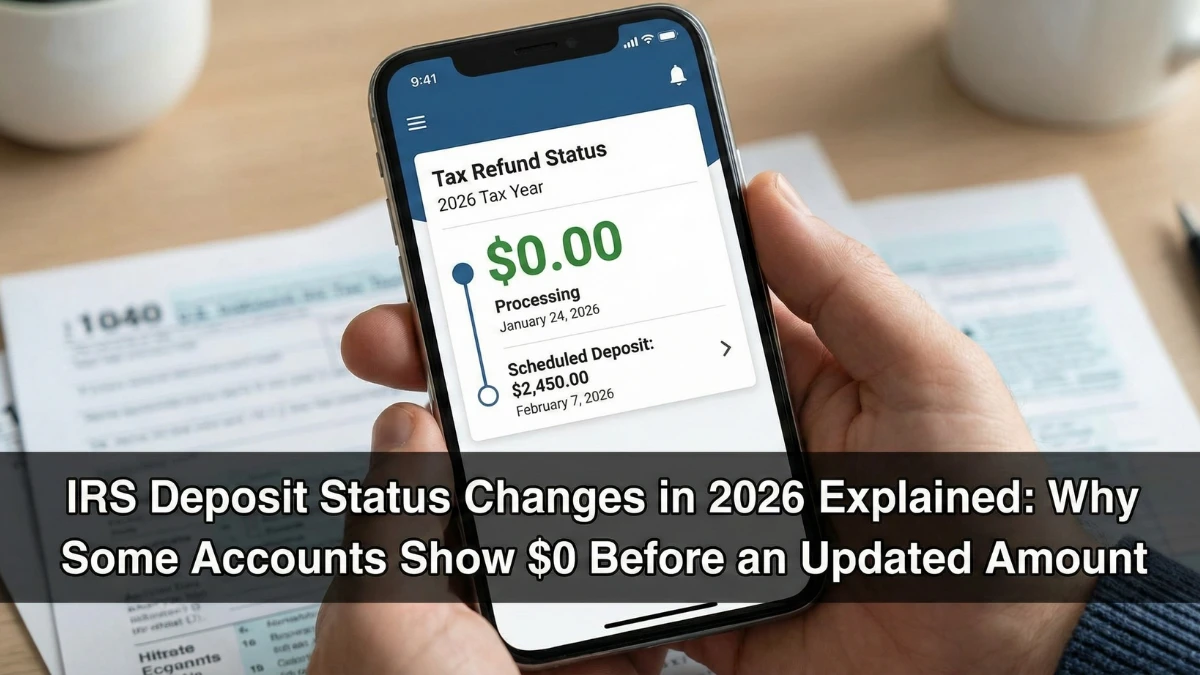

IRS Deposit Status Changes in 2026 Explained: Why Some Accounts Show $0 Before an Updated Amount

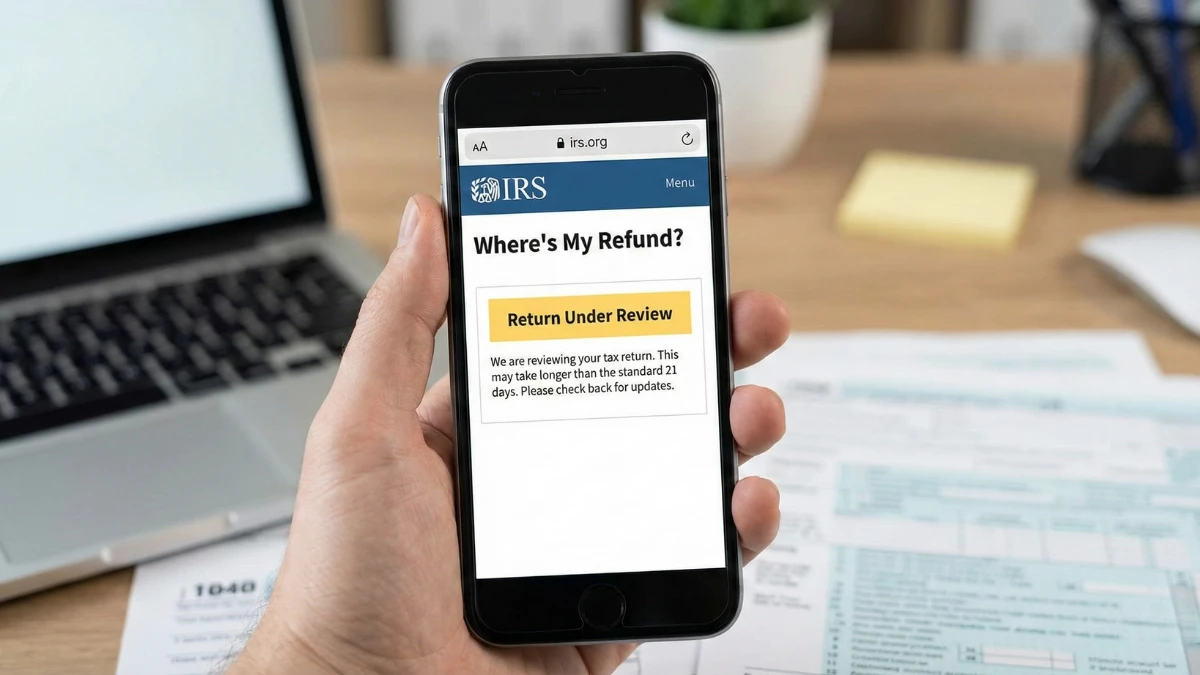

Some taxpayers notice unusual activity in 2026 where an IRS-related deposit briefly shows $0, followed later by an updated refund amount, sometimes reported as around $2,000. This can look alarming, but in most cases it reflects normal processing stages, not a new payment program or bonus. This article explains the verified reasons these status changes … Read more