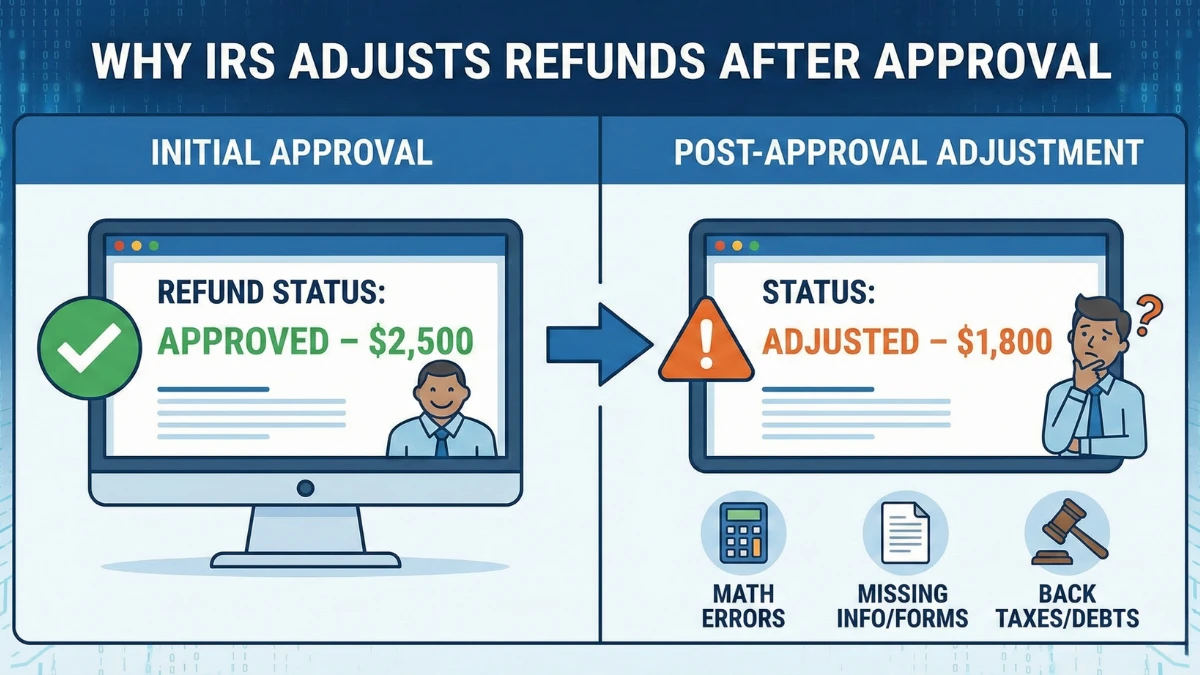

Why the IRS Sometimes Adjusts Refunds After Initial Approval

It can be confusing when a tax refund is adjusted after the IRS initially shows it as approved, especially if the amount changes or the deposit timing shifts. In most cases, these adjustments are routine corrections, not penalties or audits. This article explains the legitimate reasons refunds are adjusted, how the process works, and what … Read more