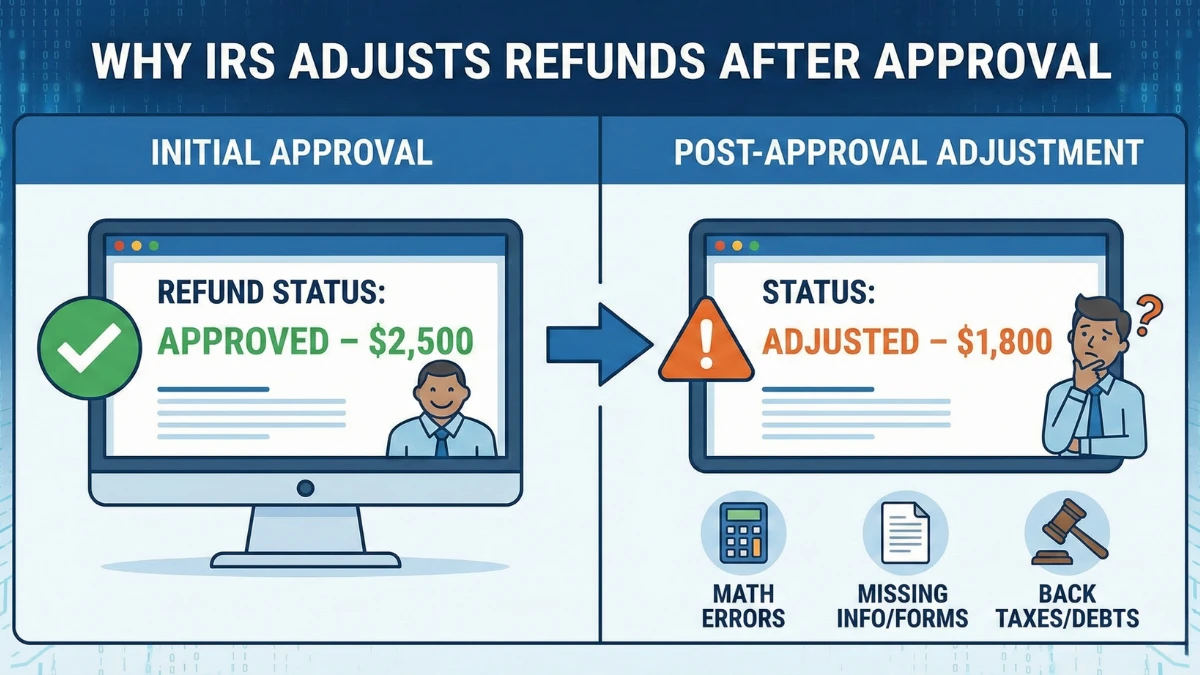

Why IRS Refunds Around $2,000 Often Receive Extra Review Before Release

Taxpayers sometimes notice that federal refunds near $2,000 take longer to process or appear to move into manual review. This can raise concerns about penalties or new rules, but in reality these reviews are part of routine IRS verification procedures. This article explains why refunds around this range are more likely to be checked, what … Read more